An Unbiased View of Second Mortgage

Table of ContentsExamine This Report on Second MortgageSome Of Second Mortgage8 Simple Techniques For Second MortgageSecond Mortgage Fundamentals Explained

Some customers utilize a home equity line of credit score (HELOC) as a 2nd home loan. A HELOC is a revolving line of credit report that is ensured by the equity in the home.The rate of interest rates on a HELOC and 2nd home loans, in general, are reduced than passion rates on credit scores cards and unsecured financial debt. Given that the very first or purchase home loan is used as a lending for buying the property, lots of people use bank loans as financings for big expenditures that might be extremely difficult to fund.

Bank loan fundings utilize your home (most likely a substantial possession) as security, so the much more equity you have in a home, the far better. Many loan providers will permit you to borrow at the very least as much as 80% of your home's worth, and some lenders will allow you obtain much more. Like all home mortgages, there is a procedure for getting a HELOC or a home equity lending, and the timeline may vary.

It can be 4 weeks, or it might be longer, depending on your circumstances. Simply like the acquisition home mortgage, there are prices connected with taking out a second home mortgage., the consumer still needs to pay closing expenses in some waythe price is included in the complete cost of taking out a second finance on a home.

The 45-Second Trick For Second Mortgage

:max_bytes(150000):strip_icc()/mortgage-69f02f04cdae4863806bd0455255106e.png)

These financings commonly come with low rate of interest, plus a tax advantage. You can make use of a bank loan to fund home enhancements, spend for higher education prices, or combine debt. Nevertheless, there are threats when taking out a bank loan, and they can be significant. Notably, you run the danger of shedding your home if you can not pay.

Pros Bank loans permit you to access the untapped equity in your house for cash money. HELOCs and home equity financings can help pay for big-ticket items like university or significant improvements. Second Mortgage. Passion prices on bank loans are normally less than on exclusive financings or credit scores cards. Disadvantages If you can not repay a bank loan, you take the chance of shedding your home.

If your home does not assess high sufficient and you don't have adequate equity in your house, you might not qualify for a second home mortgage funding. Home equity loans are another term momentarily mortgage. Instead of a home equity credit line, which has a revolving credit report limit, home equity loans are paid in lump amounts with fixed payment terms.

You can refinance a home equity finance or a HELOC adhering to essentially the same steps you would follow to re-finance the first home loan. Second Mortgage. A quiet bank loan is merely a bank loan taken on a home for down-payment money yet not revealed to the initial home mortgage loan provider on the first home mortgage

The Ultimate Guide To Second Mortgage

Bank loans can additionally be a method to combine financial debt by utilizing the cash from them to pay off other resources of impressive financial obligation, which may bring also higher rate of interest. Because the bank loan likewise uses the very same home for collateral as the first mortgage, the original mortgage has concern on the collateral must the consumer default on their settlements. more

This means that second home loans are riskier for lending institutions, which is why they request for a greater passion price on these home mortgages than on the initial home mortgage. You don't necessarily need to secure a second home loan from your initial home mortgage lending institution. When you are going shopping around momentarily mortgage, it is recommended to get rate additional reading quotes from a variety of sources, including banks, lending institution, and on-line mortgage lenders.

Since early 2020, the cost to buy a home in the U.S. has actually skyrocketed, getting to document highs. Rates have actually cooled down a little bit lately, several home owners still have significant equity in their homes as an outcome of the runup.

9 Simple Techniques For Second Mortgage

A 2nd home loan allows you turn that (generally) illiquid possession into useful cash money. You're funding on your own, so to talk. Depending on the exact car, you can decide to get cash in a lump amount (the home equity car loan) or draw progressively Recommended Site against it (the home equity line of credit rating).

Debtors that want to obtain second home loans can pick between two fundamental kinds: home equity loans or home equity lines of credit rating. A home equity finance has one of the most parallels with a first home loan. You receive all of the cash ahead of time and pay it back over time with rate of interest in dealt with month-to-month repayments.

You're billed passion only on the amount that you actually take out. Instances may include paying college tuition or embarking on a remodeling task like a home enhancement that'll take an excellent several months and whose specialists will be reimbursed in phases.

Haley Joel Osment Then & Now!

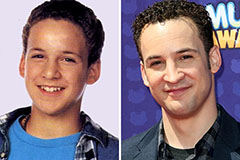

Haley Joel Osment Then & Now! Ben Savage Then & Now!

Ben Savage Then & Now! Michael Oliver Then & Now!

Michael Oliver Then & Now! Kelly Le Brock Then & Now!

Kelly Le Brock Then & Now! Robbie Rist Then & Now!

Robbie Rist Then & Now!